Earnings News Cause Immediate Stock Price Jumps, Sometimes Moving Whole Market

UC San Diego research highlights that earnings news don’t just impact individual stocks—they also affect the prices of similar companies and occasionally, the overall market index

Story by:

Published Date

Article Content

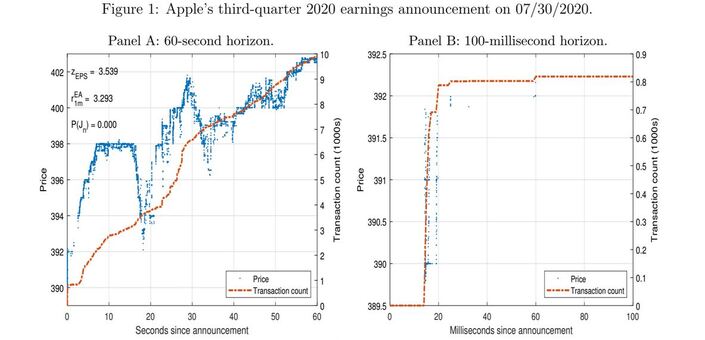

Recent weeks have vividly illustrated that stock markets respond quick to policy changes in tariffs. Just how fast the stock market can react to news is shown in a new study from the University of California San Diego’s Rady School of Management, which finds that earnings reports can move stock prices in milliseconds, triggering immediate and significant stock price movements.

The research provides the most comprehensive analysis to date of how modern financial markets process information almost instantaneously, even in the normally dormant after-hours trading session.

The study, forthcoming in the Journal of Financial Economics, analyzes over 89 billion after-hours stock quotes and finds a spillover effect—when one company announces earnings, stock prices of other firms are more likely to jump up or down as well. This effect is strongest for early announcers and companies within the same sector, but also occurs in firms in different industries, suggesting that investors quickly grasp the significance of individual companies’ earnings results for their industry and for the broader economy.

The study finds that after-hours earnings announcements cause stock prices to move in over 90% of cases, while price jumps during regular trading hours or in non-announcement sessions remain rare.

“Our research shows how efficient markets are at pricing in earnings announcements, which are the key source of financial information for individual stocks,” said Allan Timmermann, a distinguished professor of finance at the Rady School and coauthor of the study. "Markets typically know ahead of time exactly when firms will announce their quarterly earnings results. On the other hand, when it comes to events such as the war in Ukraine or the conflict in Gaza or even the impact of tariffs, while prices in financial markets tend to react quite sharply initially they typically remain highly volatile for a long time as investors absorb the news and evaluate their long-term impact on the economy.”

He added, “With earnings announcements, traders deal with these every day and they are very good at gauging the impact of companies being able to meet and beat expectations or missing them. We find that it can be very costly to miss expectations - this often leads to sharp drops in prices, sometimes affecting entire sectors.

Semiconductor and tech are examples of sectors in which spillover effects are quite strong. For example, when Qualcomm announces earnings results, the stock prices of Intel, Advanced Micro Devices, and Micron Technology, as well as that of the tech-heavy market index, are much more likely to jump in a short interval after the announcement than at times without such announcements.

“Clearly investors are paying close attention to Qualcomm’s results and their broader implications for the tech sector and the economy and when Qualcomm sneezes, semiconductors catch a cold,” Timmermann said.

Examples of spillover effects that occurred fairly recently include an earnings announcement from Illumina on Feb. 11—it disappointed the markets and its stock price went down immediately 5.5%. Over the ensuing week, Agilent Technologies, another biotech and scientific research company, also saw their stock price decline by 11.80%.

How firms use powerful computer programs to trade much faster than a human can

In addition, the researchers found that when companies as ubiquitous as Apple announce higher-than-expected earnings, they could lift the whole market up because it would be a sign of consumers having more discretionary spending. The inverse effect would occur if Apple’s earnings disappoint. Earnings announcements by companies as large and connected to the growth of the economy as Nvidia can sometimes have a similar impact on the stock market as key macroeconomic news such as job numbers or consumer spending.

Most firms announce their earnings after the regular trading session has closed in the so-called after-hours market. To understand the lower trading volumes that are typical of the after-hours market, the study developed a new statistical test designed to filter out "noise" at low trading volumes.

On non-earnings days, for most stocks it is “lights out” and there’s very little trading activity in the after-hours market because it is more costly to trade and there is little firm-specific news being announced during this time. Due to these low trading volumes, typically prices don’t move much and are stale in after-hours markets on non-announcement days.

To overcome challenges of detecting jumps in the presence of erratic and “noisy” prices in after-hours trading, the researchers developed a new statistical method to more accurately detect price jumps. Their analysis also suggests that stock markets have become increasingly efficient, with post-announcement trading opportunities virtually vanishing in recent years for anyone trading with even small delays of only a couple of seconds.

Most major brokerage firms have embraced high-frequency trading—a trading method that uses powerful computer programs to transact a large number of orders within a few thousandths of a second. Some are exploring the use of quantum computing and AI to improve trade predictions and execution speeds.

“For the biggest stocks with the highest trading volume, we find that prices move within literally milliseconds, much faster than any human could react to earnings news,” Timmermann said. “The biggest traders in these markets with access to the latest technology get first in line with executing their trades and by the time humans can react to news, it’s too late, so the adage of ‘don’t try this at home’ applies here.

Coauthors of the paper include Kim Christensen and Bezirgen Veliyev, both of Aarhus University.

Read the full study, Warp Speed Price Moves:Jumps after Earnings Announcements.

Learn more about research and education at UC San Diego in: Artificial Intelligence

Share This:

You May Also Like

Stay in the Know

Keep up with all the latest from UC San Diego. Subscribe to the newsletter today.